The Inspection Bureau of the Beijing Municipal Taxation Bureau of the State Administration of Taxation relied on the analysis of tax big data to find that the Internet big V Sima Nan was suspected of tax evasion and carried out a case inspection against him in accordance with the law.

After investigation, Sima Nan underpaid personal income tax and value-added tax by a total of 4.6243 million yuan from 2019 to 2023 by concealing income and making false declarations, and the enterprises under his actual control underpaid enterprise income tax by 753,200 yuan by falsely listing costs and enjoying tax incentives in violation of regulations.

The Beijing Municipal Taxation Bureau of the State Administration of Taxation has recovered taxes, late fees and fines totaling 9.2694 million yuan from Sima Nan and his enterprises in accordance with the law, and all of them have been put into storage.

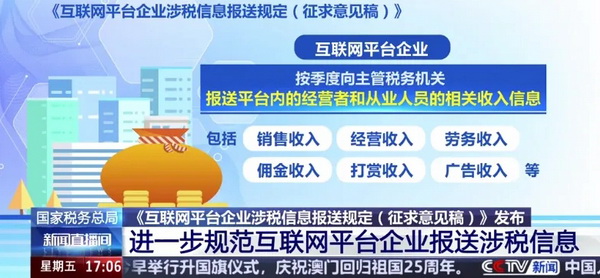

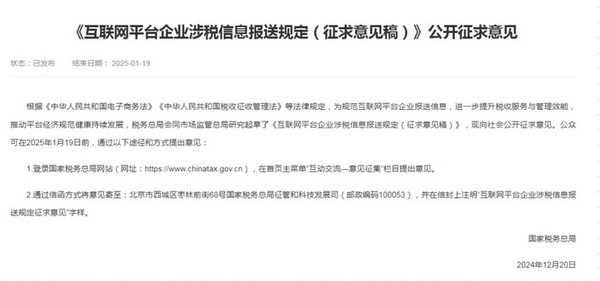

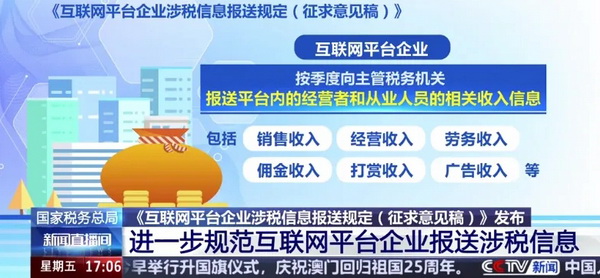

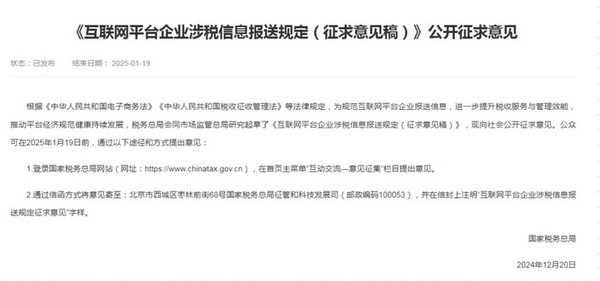

It has to be mentioned that the Provisions on the Submission of Tax-related Information by Internet Platform Enterprises (Draft for Comments) (hereinafter referred to as the "Provisions") issued by the State Administration of Taxation and the State Administration for Market Regulation directly hit the pain points of tax supervision of the platform economy and tried to reshape the market order through "source governance".

The "Provisions" require the platform to synchronize tax-related information such as the identity information of operators, income information, contract orders, transaction details, etc., which greatly enhances the regulatory ability of the tax department.

The core feature of the platform economy is "decentralization", and hundreds of millions of self-employed people and freelancers rely on the platform to carry out transactions. However, this model also presents two major tax challenges:

High information asymmetry: There are data barriers between platform companies and tax authorities. For example, there are various forms of income in the fields of live streaming and e-commerce (such as tips, commissions, and advertising shares), which are difficult to fully cover in traditional tax declarations.

Concealment of tax evasion: High-income groups evade taxes by splitting income, fictitious costs, etc. Typical cases include online anchors concealing their income through "yin-yang contracts", or even using sole proprietorships to change the nature of their income to reduce their tax burden.

Traditional supervision relies on self-declaration and post-audit by operators, but it is inefficient in the context of massive and scattered transactions. The promulgation of the "Provisions" marks the shift from "passive response" to "active control" in regulatory thinking, and directly obtains transaction information through the "data hub" of the platform to achieve source governance.

The core measures of the new regulations: penetrating supervision and classified management

The Provisions have established a "penetrating" tax regulatory framework with platform enterprises as the main body of information reporting, and the information that Internet platform enterprises need to report to the tax authorities mainly includes the following:

Identification Information

Business operators that have completed the registration of market entities: including name (name), unified social credit code (taxpayer identification number), actual business address, unique user (store) identification code, professional service organization logo, website link, etc.

Operators and employees who have not registered as market entities: They are required to submit information such as name, certificate type and number, contact information, actual business address, and unique user (store) identification code.

This is to ensure that market players are authentic and credible.

Earnings information

Sales revenue: sales of goods, return amount, net sales, etc.;

Service income: labor income, commission income, reward income, advertising income, etc.

This is to make every turnover well documented.

Analysis of the impact of the new regulations

For businesses operating in compliance with the law, the new regulations bring more dividends of fair competition, neither need to worry about "brushing peers" to disrupt the market, nor do they have additional reporting burdens, and the tax costs are basically the same as in the past.

And those operators who are accustomed to using "yin and yang contracts", fictitious transactions, and tax evasion need to be vigilant! After the platform data is directly connected to the tax system, every "hidden income" may be accurately locked, ranging from tax fines to credit penalties and even criminal liability.